I. Introduction

In today’s fast-paced world, health insurance is more important than ever. It provides a safety net for unexpected medical expenses and ensures access to necessary healthcare services. However, finding affordable health insurance can be a daunting task, with numerous options and factors to consider. This article aims to guide you through the process of choosing the right affordable health insurance that meets your needs and budget.

With rising healthcare costs, many individuals and families struggle to find a plan that offers comprehensive coverage without breaking the bank. The purpose of this article is to simplify the process and provide practical tips for selecting an affordable health insurance plan.

We’ll cover everything from understanding your health insurance needs to comparing different plans and providers. By the end of this article, you’ll be equipped with the knowledge to make an informed decision about your health insurance.

II. Understanding Your Health Insurance Needs

Before diving into the world of health insurance, it’s crucial to assess your personal and family health requirements. Consider factors such as the frequency of medical visits, potential health risks, and any chronic conditions that may require ongoing care.

Evaluating your long-term health goals is also essential. Are you planning to start a family, or do you have specific health concerns that need attention? Preventive care and wellness programs can play a significant role in maintaining good health and preventing future medical issues.

Balancing your coverage needs with budget constraints is key. While it’s tempting to opt for the cheapest plan, it’s important to ensure that it provides adequate coverage for your specific needs. After all, health insurance is an investment in your well-being.

- Assess personal and family health requirements

- Evaluate frequency of medical visits and potential health risks

- Consider long-term health goals and chronic conditions

- Importance of preventive care and wellness programs

- Balance coverage needs with budget constraints

III. Types of Health Insurance Plans

There are several types of health insurance plans available, each with its own set of benefits and limitations. Understanding these options can help you choose the right plan for your needs.

Health Maintenance Organizations (HMOs) require you to choose a primary care physician (PCP) and get referrals for specialist care. They often have lower premiums and out-of-pocket costs but limited provider networks.

Preferred Provider Organizations (PPOs) offer more flexibility in choosing healthcare providers and don’t require referrals for specialists. However, they typically come with higher premiums and out-of-pocket costs.

Exclusive Provider Organizations (EPOs) combine features of HMOs and PPOs. They don’t require referrals but have a limited network of providers. Point of Service (POS) plans offer flexibility in choosing providers and require referrals for specialists. Finally, High Deductible Health Plans (HDHPs) paired with Health Savings Accounts (HSAs) can be a cost-effective option for those who don’t anticipate frequent medical expenses.

- Health Maintenance Organizations (HMOs)

- Preferred Provider Organizations (PPOs)

- Exclusive Provider Organizations (EPOs)

- Point of Service (POS) plans

- High Deductible Health Plans (HDHPs) and Health Savings Accounts (HSAs)

IV. Key Factors to Consider When Choosing a Plan

When selecting a health insurance plan, several key factors should be taken into account. These include premiums, deductibles, and out-of-pocket maximums. It’s essential to understand how much you’ll be paying monthly and what your financial responsibility will be in case of medical expenses.

The network of doctors and hospitals is another crucial consideration. Ensure that your preferred healthcare providers are included in the plan’s network to avoid unexpected costs. Coverage for prescription drugs is also important, especially if you require regular medications.

Additionally, consider the availability of mental health services and any additional benefits such as dental, vision, and wellness programs. These can enhance your overall healthcare experience and contribute to your well-being.

- Premiums, deductibles, and out-of-pocket maximums

- Network of doctors and hospitals

- Coverage for prescription drugs

- Availability of mental health services

- Additional benefits such as dental, vision, and wellness programs

V. Comparing Health Insurance Providers

Researching and comparing different insurance companies is a vital step in finding the right health insurance plan. Start by reading reviews and customer satisfaction ratings to get an idea of the experiences of other policyholders.

Understanding the financial stability and reputation of insurers is also important. You want to choose a provider that is reliable and capable of handling claims efficiently. Evaluating customer service and support options can give you insight into how responsive and helpful the insurer will be when you need assistance.

Finally, consider the ease of claims processing and reimbursement. A smooth and hassle-free claims process can make a significant difference in your overall experience with the insurance provider.

- Research and compare different insurance companies

- Read reviews and customer satisfaction ratings

- Understand the financial stability and reputation of insurers

- Evaluate customer service and support options

- Consider the ease of claims processing and reimbursement

VI. Utilizing Government and Employer-Sponsored Options

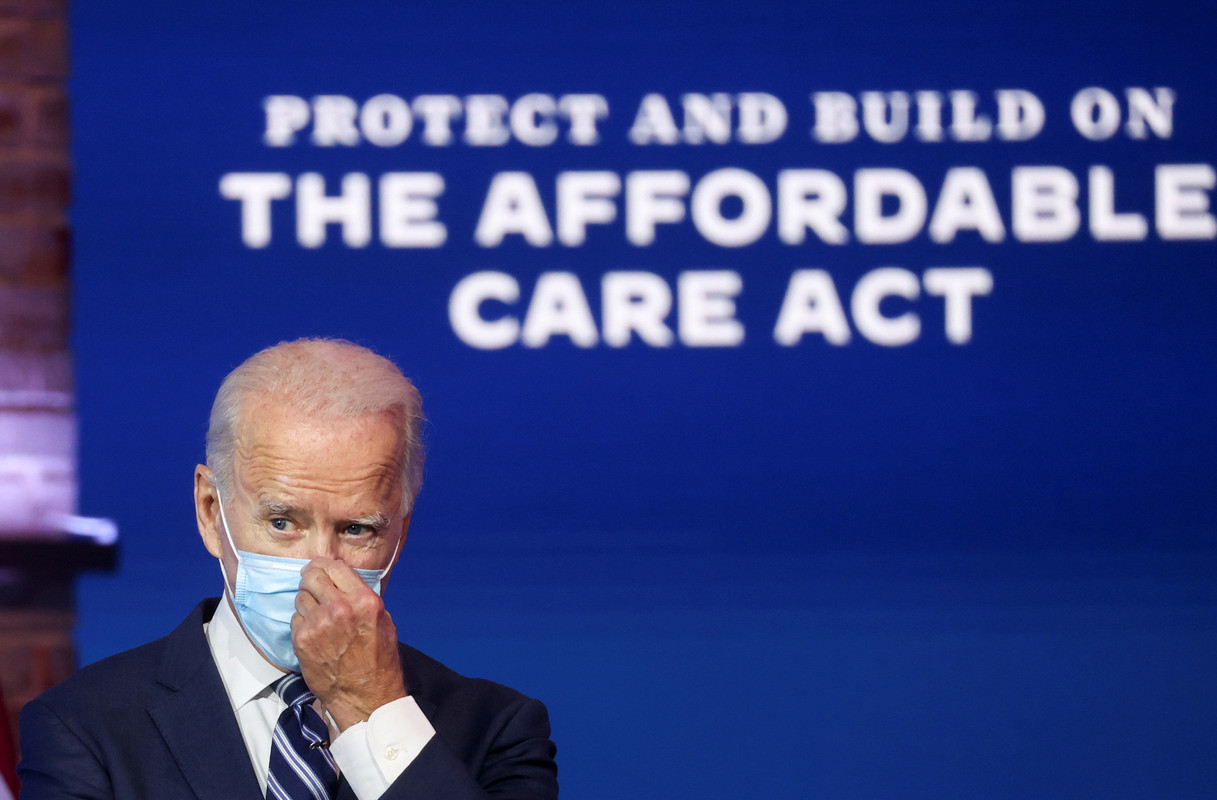

The Affordable Care Act (ACA) and marketplace plans provide options for individuals and families to find affordable health insurance. These plans often come with subsidies and tax credits to help reduce costs.

Medicaid and the Children’s Health Insurance Program (CHIP) offer coverage for low-income individuals and families. Eligibility varies by state, so it’s important to check the specific requirements in your area.

For seniors and disabled individuals, Medicare provides comprehensive coverage. Additionally, employer-sponsored health insurance benefits can be a cost-effective option, often with the added advantage of employer contributions. If you’re transitioning between jobs, COBRA continuation coverage allows you to maintain your existing health insurance for a limited period.

- Overview of the Affordable Care Act (ACA) and marketplace plans

- Medicaid and Children’s Health Insurance Program (CHIP) eligibility

- Medicare options for seniors and disabled individuals

- Employer-sponsored health insurance benefits

- COBRA continuation coverage for transitioning between jobs

VII. Tips for Reducing Health Insurance Costs

There are several strategies you can use to reduce health insurance costs. Taking advantage of subsidies and tax credits can significantly lower your premiums. Participating in wellness programs and preventive care can help you stay healthy and avoid costly medical expenses.

Choosing generic medications and using mail-order pharmacies can save you money on prescription drugs. Additionally, negotiating medical bills and seeking financial assistance can help reduce out-of-pocket costs.

Exploring telehealth options for cost-effective care is another great way to save money. Telehealth services often have lower copays and can provide convenient access to healthcare professionals from the comfort of your home.

- Take advantage of subsidies and tax credits

- Participate in wellness programs and preventive care

- Choose generic medications and use mail-order pharmacies

- Negotiate medical bills and seek financial assistance

- Explore telehealth options for cost-effective care

VIII. Conclusion

Choosing the right affordable health insurance is crucial for ensuring access to necessary healthcare services and protecting yourself from unexpected medical expenses. By understanding your health insurance needs, comparing different plans and providers, and utilizing available resources, you can make an informed decision that meets your needs and budget.

Remember to regularly review and adjust your health insurance plan as needed to ensure it continues to meet your evolving healthcare needs. With the right plan in place, you can enjoy peace of mind knowing that you and your family are protected.

For more tips on financial planning, check out our articles on smart tax planning and retirement planning for digital nomads. And if you’re looking for some fun, don’t miss our guide on generating cute cat pictures with AI!

FAQ

What is the difference between an HMO and a PPO?

HMOs require you to choose a primary care physician and get referrals for specialist care, while PPOs offer more flexibility in choosing healthcare providers and don’t require referrals for specialists.

How can I reduce my health insurance costs?

You can reduce health insurance costs by taking advantage of subsidies and tax credits, participating in wellness programs, choosing generic medications, negotiating medical bills, and exploring telehealth options.

What should I consider when comparing health insurance providers?

When comparing health insurance providers, consider factors such as premiums, deductibles, out-of-pocket maximums, network of doctors and hospitals, coverage for prescription drugs, availability of mental health services, and additional benefits.

Are there government programs that can help with health insurance?

Yes, government programs such as the Affordable Care Act (ACA), Medicaid, the Children’s Health Insurance Program (CHIP), and Medicare provide options for affordable health insurance coverage.

What are the benefits of employer-sponsored health insurance?

Employer-sponsored health insurance often comes with lower premiums due to employer contributions and may offer additional benefits such as dental, vision, and wellness programs.